The Overlooked Financial Document

Most people glance at their pay stub once, if at all, before tossing it aside or leaving it unopened in their online account. But that little document holds more power than it seems. It’s not just a breakdown of hours and wages—it’s a roadmap of where your money is going, from taxes to retirement contributions. Overlooking it could mean missing errors, overpayments, or missed opportunities to adjust your financial plan. Just like people sometimes refinance personal loan balances to reduce their monthly costs and keep more money in their pocket, checking your pay stub regularly helps you make sure your income is working as efficiently as possible.

Catching Payroll Mistakes Early

Payroll errors happen more often than many realize. Whether it’s an incorrect hourly rate, a missing overtime payment, or the wrong deduction for insurance, small mistakes can add up to significant losses over time. If you don’t catch them, you might never get that money back. Reviewing your pay stub gives you the chance to spot and fix these problems quickly, before they snowball.

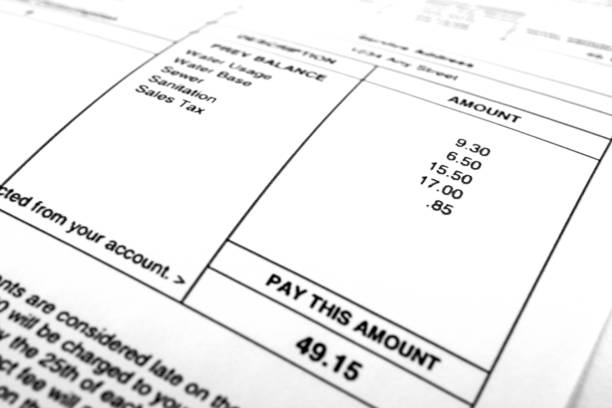

Understanding Where Your Money Goes

Your pay stub shows you more than just your take-home pay. It breaks down your gross income, taxes withheld, retirement contributions, health insurance premiums, and other deductions. By reading it closely, you can better understand how much of your paycheck is being allocated to different areas of your financial life. This knowledge puts you in control. For example, if you notice your retirement contributions are lower than expected, you might increase them to meet your savings goals.

The Link to Tax Accuracy

When tax season rolls around, the information on your pay stub becomes especially important. Your withholdings affect whether you’ll owe money or get a refund. If your employer is withholding too much or too little, you could be in for an unpleasant surprise. Regularly reviewing your pay stub ensures your withholdings are accurate and gives you the chance to make adjustments throughout the year, rather than scrambling in April.

Planning for Future Goals

Looking at your pay stub isn’t only about catching mistakes—it’s also about making informed choices for your future. Maybe you want to pay off debt faster, build an emergency fund, or invest more aggressively. Knowing exactly where your money is going helps you figure out what adjustments are possible. By keeping track of deductions, you can see whether you have room to redirect funds toward your goals without straining your budget.

Spotting Hidden Fees or Deductions

Sometimes deductions appear that you may not fully understand. It could be union dues, benefit program fees, or contributions you didn’t realize you had opted into. While these aren’t always bad, it’s important to know what they are and decide whether they still serve your needs. Reviewing your pay stub regularly ensures you’re not paying for services or benefits you no longer use.

Preventing Identity or Benefit Issues

It may not be the first thing that comes to mind, but checking your pay stub can also protect you against identity theft or benefits errors. If your information is entered incorrectly or someone else has tampered with your payroll records, you could see strange deductions or changes in your pay stub. Regular reviews let you catch these red flags before they cause serious harm.

Building Financial Awareness

There’s also a psychological benefit to regularly reviewing your pay stub. It forces you to be more engaged with your money and encourages financial awareness. Seeing your earnings and deductions in black and white can be eye-opening, especially if you realize how much is going to taxes or other costs. This awareness motivates smarter choices, from spending habits to savings strategies.

Conclusion: A Small Step with Big Impact

Reviewing your pay stub may seem like a minor habit, but it’s one that builds financial empowerment over time. It ensures you catch errors, understand your deductions, and keep your financial goals on track. Just as you would keep a close eye on debt payments or savings balances, your pay stub deserves regular attention. In the long run, this simple practice strengthens your financial foundation and prevents unnecessary surprises.