Table of Contents

- Introduction

- Understanding Business Lines of Credit

- Benefits of a Business Line of Credit

- Eligibility Criteria

- Common Mistakes to Avoid

- Steps to Apply for a Business Line of Credit

- Conclusion

Introduction

For most growing companies, maintaining access to capital can mean the difference between stagnation and seizing a market opportunity. A business line of credit is one of the most flexible financing tools available to entrepreneurs and SMEs, providing a revolving source of funds that can be accessed whenever needed. Whether you’re managing cash flow, bridging seasonal slowdowns, or financing a sudden opportunity, you can get a business line of credit tailored to your specific needs. This financial safety net ensures you’re always ready to respond to your business’s changing needs.

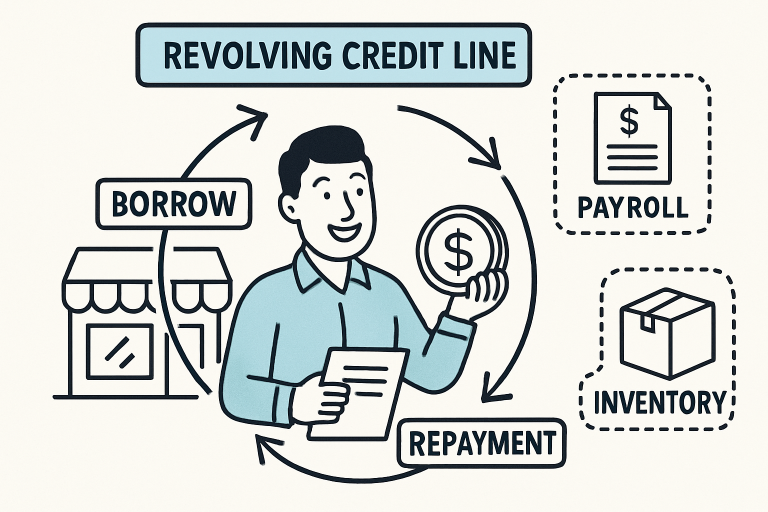

By leveraging a business line of credit, companies can address both planned expenses and urgent cash needs, ensuring smooth operations and continuous growth. Unlike fixed loans that provide a lump sum, lines of credit only incur interest on funds you’ve withdrawn, offering both agility and cost efficiency. The ability to borrow, repay, and borrow again up to a set limit allows business owners to manage working capital better, prepare for the unexpected, and strategically invest in their business without the constant burden of reapplying for new loans.

Understanding Business Lines of Credit

A business line of credit functions like a credit card, but with higher limits and terms tailored to business needs. Approved borrowers can draw up to a preset limit and pay interest only on the funds actually used, unlike a term loan, where interest accrues on the full amount from the start. With this revolving structure, funds become available again as you repay what you’ve used, supporting ongoing working capital needs for payroll, inventory, or receivables. For a detailed overview of how business lines of credit work, Business News Daily provides a helpful guide.

This flexibility is especially beneficial for companies facing seasonality, cyclical revenue, or unexpected operational costs. Construction firms, retailers, and service providers can all leverage lines of credit as a lifeline between receivables and payment of vendors, rent, or employees. The ability to draw and repay repeatedly, without lengthy approval processes, gives businesses a strategic liquidity advantage when every day counts.

Benefits of a Business Line of Credit

- Flexibility: Borrow only what you need, when you need it, which helps avoid unnecessary debt.

- Interest Savings: Since you pay interest only on the amount drawn, this can result in significant cost savings compared to traditional loans.

- Improved Cash Flow: Using a line of credit helps you smooth seasonal sales fluctuations and cover unexpected business expenses.

- Opportunity Seizure: Acting quickly is essential to capitalize on new opportunities—lines of credit offer rapid access to funds with minimal delays.

Eligibility Criteria

Lenders evaluate several factors when determining whether a business is eligible for a line of credit. The three most essential requirements are:

- Credit Score: Lenders typically require a minimum FICO score of 600, but higher scores often lead to better interest rates and larger credit limits.

- Business Revenue: Stable, reliable revenue is a must; lenders usually look for at least $10,000 in consistent monthly gross receipts to ensure the ability to repay borrowings.

- Time in Business: Most lenders prefer companies with at least two years of operating history to demonstrate reliability and risk tolerance.

Preparation can make the application process smoother. Before applying, review your credit reports, collect recent financial statements, and tally your average monthly income and expenses. Understanding your own business metrics is the first step to a successful outcome.

Common Mistakes to Avoid

While business lines of credit offer many benefits, it’s essential to avoid some common pitfalls:

- Inaccurate Information: Submitting incorrect or inconsistent data with your application can lead to delays or outright rejection. Double-check all financial and business details for accuracy.

- Insufficient Credit History: A limited or poor credit history may result in unfavorable terms, higher interest rates, or application denial. Work on building and maintaining a strong business credit profile.

- Overborrowing: It can be tempting to draw more than you need, but overextending can create unnecessary debt and high interest payments. Use your credit line for specific, strategic purposes.

Steps to Apply for a Business Line of Credit

- Assess Your Needs: Clearly define the amount of credit you require and its intended uses. Matching your request to your business needs can increase your approval odds.

- Check Eligibility: Ensure you meet the minimum criteria for credit score, revenue, and business tenure.

- Gather Documentation: Most lenders will ask for business tax returns, profit-and-loss statements, bank statements, and, sometimes, a business plan outlining how you intend to use the credit.

- Research Lenders: Compare offers from banks, credit unions, and alternative lenders to find the best fit for your business goals and financial situation.

- Submit Application: Complete the lender’s application accurately and attach all required documentation. Incomplete submissions can cause unnecessary delays.

- Review Offers: Examine all terms, including interest rate, draw fees, repayment schedule, and any restrictions, before accepting. Don’t hesitate to negotiate or consult with a financial advisor if terms seem unclear.

Conclusion

A business line of credit is a powerful financial tool that provides both stability and flexibility for companies at every stage. By carefully preparing, meeting eligibility benchmarks, and borrowing responsibly, business owners can unlock the full value of a line of credit to navigate cash flow challenges and power sustained growth.