Table of Contents

- Embracing Flexible Workspaces

- Integrating Sustainable Practices

- Leveraging Technology and PropTech

- Investing in Mixed-Use Developments

- Prioritizing Tenant Experience

- Navigating Financial Considerations

- Adapting to Market Shifts

- Conclusion

Commercial real estate is undergoing a significant transformation driven by technological innovation, evolving workforce expectations, and an increased commitment to sustainability. In New Mexico, this evolution is clear, with businesses seeking expert guidance to adapt effectively. When it comes to navigating these changes and making sound investments, Santa Fe NM real estate experts Summit Group Real Estate Professionals offer industry-leading advice tailored to the modern market. Businesses that adapt quickly to new strategies can gain a substantial competitive advantage in this dynamic sector.

With today’s businesses prioritizing flexibility, well-being, and operational efficiency, commercial real estate (CRE) strategies must be more versatile than ever. The demand for adaptable workspaces, innovative technologies, and tenant-centric services continues to shape CRE investments. Modern firms must balance financial resilience, shifting market trends, and the growing expectation for green, high-performance buildings. These factors underscore the importance of a consultative approach in managing CRE assets for long-term value.

Embracing Flexible Workspaces

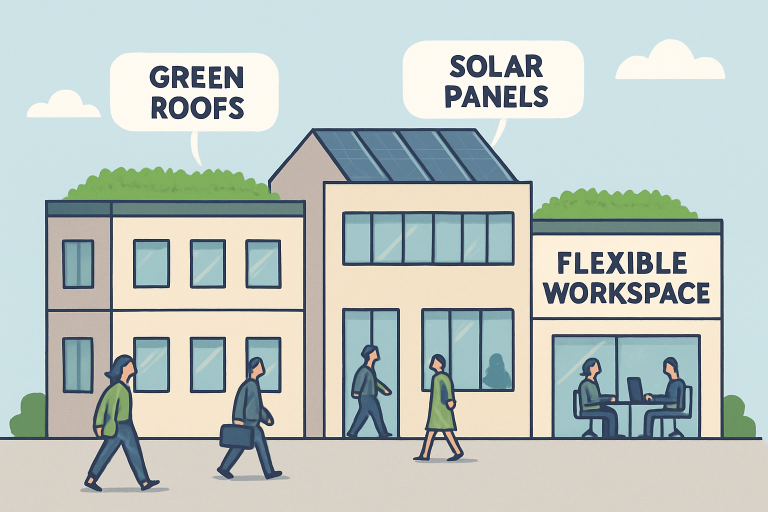

The transition to remote and hybrid work has triggered a large-scale reassessment of office needs. Many organizations are reevaluating their traditional office footprints, pivoting instead toward flexible workspaces that accommodate various work styles and schedules. This move has spurred demand for coworking spaces, office hoteling, and shorter, more adaptable lease arrangements. Companies benefit from streamlined costs and the agility to adjust space usage in response to fluctuating workforce needs.

Integrating Sustainable Practices

Environmental stewardship is at the forefront of CRE strategy. Tenants and investors alike are seeking buildings with green credentials, resulting in a premium for energy-efficient, environmentally certified properties. Features such as improved insulation, efficient lighting, water-saving systems, and renewable energy solutions are becoming standard. Studies show that green-certified properties not only command higher rents but also enjoy better occupancy rates. By incorporating sustainability, property owners reduce operating costs, appeal to eco-conscious tenants, and demonstrate corporate responsibility.

Leveraging Technology and PropTech

The rise of property technology (PropTech) is revolutionizing the management and experience of commercial buildings. AI-powered analytics, IoT-enabled systems, and smart automation tools help owners manage everything from energy consumption to security and maintenance with greater accuracy. For example, AI-driven HVAC and lighting systems can optimize building performance and reduce costs by up to 30%. Cloud-based platforms give CRE professionals powerful insights into market trends, tenant preferences, and investment opportunities. With technology driving operational efficiencies and enhancing tenant experiences, CRE stakeholders are increasingly integrating these innovations into both new and existing properties.

Investing in Mixed-Use Developments

Mixed-use developments are rapidly gaining traction as communities and businesses recognize their multifaceted advantages. These projects blend office, retail, and residential components, creating vibrant, self-contained corridors where people can live, work, and socialize. Such flexibility not only attracts a broader spectrum of tenants but also generates higher foot traffic for retail and service providers, thereby increasing the asset’s resilience to market fluctuations. Mixed-use environments appeal to the growing desire for walkability, local amenities, and integrated urban experiences, redefining how people interact with commercial spaces.

Prioritizing Tenant Experience

The emphasis on tenant experience is stronger than ever. Factors such as in-building amenities, wellness features, and digital connectivity have transformed from optional extras to critical expectations. On-site gyms, green spaces, collaborative lounges, secure access controls, and next-generation internet access are becoming standard. Satisfied tenants are more likely to stay, and positive experiences translate to lower turnover, extended leases, and higher rents. Owners can enhance retention and property value by continually investing in services and amenities that meet the evolving needs of tenants.

Financial resilience has never been more crucial, given macroeconomic uncertainty and the sizable volume of maturing CRE loans. Businesses must reassess portfolio strategies, negotiate favorable leases, and maintain cash flow flexibility to weather interest rate changes and investment volatility. Proactive financial planning involves diversifying holdings, managing risk exposure, and utilizing market analyses to anticipate potential shifts. CRE stakeholders who align their space needs and economic models with business goals will be positioned to capitalize on emerging opportunities while minimizing exposure to downturns.

Adapting to Market Shifts

Staying agile is key in today’s evolving real estate landscape. Businesses need to monitor remote work patterns, demographic shifts, and regulatory changes to make informed decisions about property assets. This often involves evaluating alternative uses for existing properties, such as converting offices to residential or flexible event space, in response to market demands. Expansion into new regions or property types may also be viable as the market normalizes and new trends emerge. Forward-thinking real estate strategies require regular review and adjustment in line with broader economic and societal trends. To succeed in modern commercial real estate, businesses must embrace flexible, innovative, and sustainable practices. By focusing on long-term value, tenant experience, and financial stewardship, firms can thrive amid continued market transformation and uncertainty.

Conclusion

Success in today’s commercial real estate market hinges on adaptability, innovation, and long-term vision. By embracing flexible workspaces, sustainable design, and technology-driven solutions, businesses can create environments that attract tenants and optimize performance. Pairing these strategies with careful financial planning and an eye on evolving market trends ensures lasting value and resilience. Forward-thinking organizations that invest in people, places, and progress will not only keep pace with industry changes but also gain a competitive advantage in shaping the future of commercial real estate.